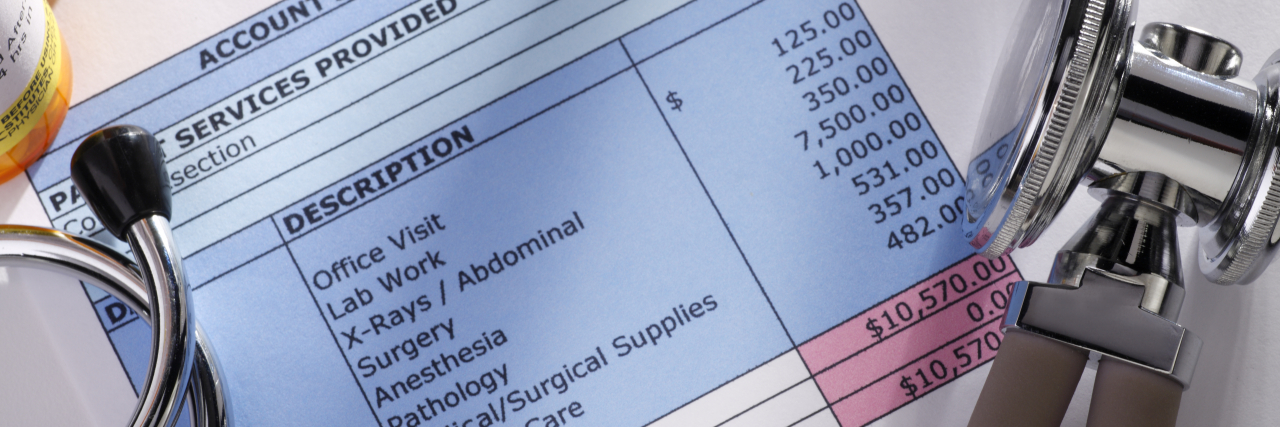

The 'No Surprises Act' -- What You Need to Know

On January 1, the federal “No Surprises Act” took effect in the United States. The statute protects patients when receiving emergency care, non-emergency care from out-of-network providers at in-network sites, and air-ambulance care from out-of-network providers.

Under the act, physicians are required to give disclosure about protections against balance billing — namely, passing the difference between what the doctor charged and the insurance company paid onto the patient — to everyone enrolled in commercial health insurance. These protections were already afforded to those Americans covered by Medicare and Medicaid.

The statute also outlines rules about when patients do not consent to post-stabilization care at out-of-network emergency departments, as well as in what cases consent can be sought.

Additionally, medical providers are required to give good-faith estimates of costs for self-pay and uninsured patients, as well as information about patients’ rights. If the difference in costs exceeds $400, then the bill can be disputed for up to 120 days after the billing date.

“The No Surprises Act is the most critical consumer protection law since the Affordable Care Act,” said Health and Human Services Secretary, Xavier Becerra. “After years of bipartisan effort, we are finally providing hardworking Americans with the federal guardrails needed to shield them from surprise medical bills.”

Previously, some states had protections against surprise billing, and the new law supplements — but doesn’t supplant — them.

For more information about the “No Surprises Act,” visit the Centers for Medicare and Medicaid Services website.

Getty image by DNY59.