Woman’s $19K Hospital Bill Highlights How Unaffordable Mental Health Care Can Be

Editor's Note

If you experience suicidal thoughts, the following post could be potentially triggering. You can contact the Crisis Text Line by texting “START” to 741741.

On Nov. 1, Nicole Vlaming posted on Facebook about the unwelcome surprise she got after a recent three-day inpatient stay at a hospital for a mental health emergency — a bill totalling nearly $20,000. Her experience highlights why we need better access to affordable mental health treatment: “You want to know why people don’t seek help?” she wrote. “This is why.”

She continued in her Facebook post:

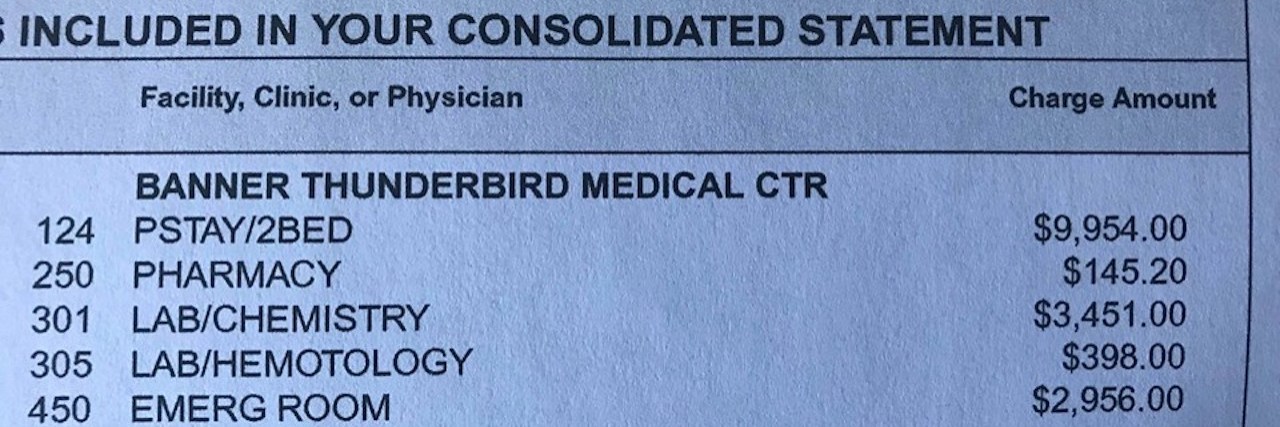

Two weeks ago today, I walked into the ER because if I didn’t I was going to kill myself. I was stripped of all my clothes and possessions, given disposable scrubs and put in a room for the next 5 hours. In the US, this costs nearly $3,000. I was then placed in the behavioral health ward until Sunday at noon. Three nights, two and a half days. Because it was a weekend, all therapy was scaled back, both in number of sessions and the quality of sessions. During one we simply played a trivia game. I sat around watching TV all day and chatting with a Vietnam vet. In the US this costs nearly $10,000. During this stay, I had blood drawn twice. That was another $3,800. Not shown are the “physician charges” that bring my grand total to over $18,000. I saw an MD once and had once daily sessions with a psychiatrist. Those sessions consisted of rating my depression on scale of 1-10 and asking if I want to hurt myself or anyone else. Real stellar care. /s Oh, I almost forgot to point out the $145 for 3 days worth of meds. I normally pay less than $50 for an entire month. My employer sponsored insurance does not cover inpatient mental health care in any capacity. I do have a supplemental insurance plan that will hopefully cover $6,000, leaving me on the hook for over $12,000.

Vlaming did what most mental health patients, herself included, are advised to do in a crisis — go to the emergency room. She admitted herself at Arizona-based Banner Thunderbird Medical Center because she was feeling suicidal. It’s the first time she was hospitalized for her mental health.

“[They] gave me the disposable scrubs and put me in a room with a glass door and basically just left me there for several hours until they could get someone to evaluate me,” Vlaming told The Mighty. “I was really unsure because part of me did think that I needed inpatient treatment but I also didn’t know what that treatment would entail. I didn’t know what would happen. I didn’t know how long they would keep me there.”

Friday, the first day of Vlaming’s stay, she attended therapy groups she found to be supportive. This included one that focused on the book “The Roadmap to Peace of Mind” and one whose speaker was motivational. Like many inpatient hospitals, however, services scale back over the weekend. In addition, the hospital’s groups weren’t always accessible.

“They put out the schedule of the therapy sessions and what time they’re held, but in the wing, there’s only one clock and it’s not in a very visible spot,” Vlaming said. “Some of the sessions were held in another wing and the nurses may or may not let you know. … Until they mentioned the first time if I wanted to go join the one group that was in another wing, I didn’t know there was another wing of the behavioral health unit.”

The “Roadmap” group Vlaming found helpful on Friday turned into a session about treatment options after discharge on Saturday. Vlaming said while this was good information, it wasn’t group therapy. They played trivia in a group on Sunday. Vlaming expressed her concerns about the quality and cost of her stay when she talked to a member of Banner Health’s executive staff.

“I actually talked to the CEO of the behavioral health wing,” Vlaming said. “He was concerned about how I obviously wasn’t pleased with my treatment there. … When I was saying how some of my complaints were based solely on the cost, he made a comment about how he could go on and on about why healthcare costs as much as it does.”

Banner Health President/CEO Peter Fine, who oversees the parent nonprofit organization of the hospital where Vlaming received care, was paid $8,724,753 in fiscal year 2016, according to the company’s tax filings. That includes a $1,318,397 base salary and bonus/incentive pay worth $1,886,077. The rest is deferred compensation and an additional $31,000 in nontaxable benefits. While it will likely take Vlaming years to pay off her bill, Fine will have earned that same amount after a little less than five hours of work. Other executive-level employees at the company earned near or over $1 million in 2016. Reports indicate that Banner Health made $269 million in profit in 2016 and $709 million in 2017.

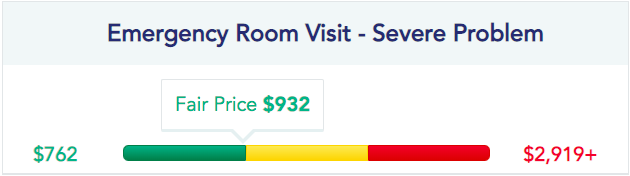

Banner Health’s cost of care, as observed on Vlaming’s bill, generally seems to rank above average compared to what other Arizona hospitals charge. According to Healthcare Bluebook, the “fair” cost of an emergency room visit for a “severe problem” is $932, nearly three times what Vlaming was charged. This tracks with one 2012 study that found hospitals typically charge 2.5 times more than the reported cost of care.

Vlaming was also billed $145.20, labeled “pharmacy,” for a three-day supply of the generic antidepressant bupropion (brand name Wellbutrin). Vlaming said she was charged $22.22 per pill, more than she pays for a monthly supply at home. A quick search on ScriptSave WellRx, and you can find 180 100-mg tablets for $24. On the more conservative end, most area pharmacies charge $78-89 for about a month’s worth of pills.

Vlaming’s hospital bill is also indicative of the confusion and lack of transparency inherent in U.S. health care. On its website, Banner Health explains the difference between “direct pay” and “self-pay” billing. The direct pay cost for an inpatient stay at Banner Behavioral Health Hospital is $22,674, not including extra charges from attending doctors. Self-pay on the same terms is $4,625.

Direct pay is defined as “the maximum price that a patient would pay for the standard treatments…regardless of insurance status, if paid directly by the patient.” Self-pay, meanwhile, is “based upon the average usual and customary charges typically incurred for the listed inpatient and outpatient diagnoses/services, discounted based upon the average of the amounts generally paid to the specific Banner hospital for such diagnoses/services by Medicare and commercial insurers.”

Neither definition explains the large difference in cost for the same care. Why do patients like Vlaming receive such costly medical bills? The numbers don’t add up — or make sense. Hospitals aren’t quick to reveal what they charge for care either, as outlined in a Washington Post report.

Banner Health agreed to an $18 million settlement in 2018 after a whistleblower alleged the company had been over-billing both Medicare and Medicare patients for nearly a decade. It also has an F-rating with the Better Business Bureau thanks to 69 customer complaints over the last three years, 54 of which are billing related.

Vlaming does have health insurance coverage through an employer-sponsored Aetna plan. But, as she describes, “The insurance I have is so bad I might as well not have insurance.” Her plan only covers a total of three doctor visits per year, including the psychiatric physician assistant she has been seeing this year for medication management.

She also has a supplemental insurance plan she hopes will cover a portion of her hospital bill, but she’ll likely have to jump through many hoops to use it — the physician who treated Vlaming at the hospital needs to fill out a form first. Even then, she’s on the hook for thousands of dollars she can’t afford.

Banner Health’s answer to the dilemma Vlaming and those like her find themselves in is a payment plan or financial assistance. However, each hospital’s policies are different, and many times discounted rates for self-pay or other assistance options aren’t openly communicated with patients. Many financial assistance plans exclude people like Vlaming, including Banner’s, who are in a health care coverage gap arguably defined as “underinsured.”

“All hospitals owned or operated by Banner Health offer generous, by industry standards, basic and enhanced financial assistance programs to uninsured patients,” Jeff Nelson, Banner Health’s director of public relations, told The Mighty in an email. “An uninsured patient is someone who does not have any health coverage at all, whether through insurance or any government program, and who does not have any right to be reimbursed by anyone else for their health care expenses.”

Vlaming got the same story about Banner’s financial assistance program, which is also outlined on its website. Because she has insurance coverage, even though it does not cover inpatient mental health treatment, Vlaming doesn’t qualify for any financial assistance through the hospital. She’s on the hook for the full amount listed on her bill.

However, according to the nonprofit’s 990 tax filings for 2016, Banner Health indicated it offers an “underinsurance discount,” which implies it would offer assistance to patients who have minimal coverage like Vlaming. There’s no indication of this type of discount anywhere on the company’s website, it was not mentioned by Nelson and not offered to Vlaming, even when she talked to the hospital’s billing department to clarify its financial assistance programs.

With limited insurance coverage, the hospital bill strains Vlaming’s financial resources. But the real cost is much higher. It puts her and others who receive large medical bills in a position to put a price tag and limits on their wellbeing. Patients can’t always afford the very treatment they need to save their life.

“If I had known that I was going to get a $19,000 bill I would not have gone in,” Vlaming told The Mighty. “I don’t know what the consequences would have been if I hadn’t, but I would not have gone in. … I’m actually going to be cashing out my IRA to pay for it.”

Costly hospital bills also impact the ability to afford ongoing outpatient mental health care. “I did find some affordable therapy through an online source, however, I had to promptly cancel that when I got this bill,” Vlaming said.

A growing body of research indicates that preventative efforts, such as suicide prevention and affordable access to outpatient psychotherapy and medication management, can cost-effectively lower the need for inpatient emergency care. Outpatient services, however, are also not affordable for many who need it right now. Arguably, Banner Health, like other hospitals across the U.S., critically fails many who need mental health care.

For Vlaming, the medications she was prescribed in the hospital are working for her, and she hopes she never has to go back. She has also started a blog, Accidental Activist, to “make some noise” about the state of health care in the U.S. In the meantime, Vlaming proposed one step toward better mental health that starts at home.

“Let people know that they’re not a burden because most of the year that’s how I’ve really felt, is that I’m worthless and that I’m a burden on others,” Vlaming said. “Try to let people understand that they’re not a burden and that they do have worth.”

Header image via Nicole Vlaming’s Facebook page.